Consumers are becoming more aware that the various “free” applications they use daily, are not really free. The app owner is mining data and that’s where their revenues really come from. But consumers do have security concerns and are expecting, even demanding that their data is secure… especially in mobile banking applications.

A recent FORBES article stated: “Consumers are eager to increase their usage of mobile banking tools and applications. They want cool new features but are often confused by them. Financial institutions have an opportunity to change that. Consumers aren’t always logical in their banking habits. They’re scared to death about data security and privacy, but that doesn’t stop them from using online or mobile banking tools heavily.

In fact, consumers’ digital banking engagement overall is growing. People are also fairly adventurous, willing to try new things even when it means taking a few risks. Despite years of bad press about cyberattacks and data breaches, their enthusiasm for digital banking solutions has not dampened. Indeed, they want to do more things digitally related to their financial lives. Active companies in the markets this week include: Social Reality, Inc., Bank of America Corporation, Citigroup Inc., E*TRADE Financial Corporation, TD Ameritrade Holding Corporation.

Another article added: “Mobile phones can provide lots of information about their owners, but most banks aren’t taking advantage, often because they don’t know what is available or because they don’t have the expertise to use the mobile information well. Mobile location data is more than just knowing where someone is, and utilizing this data to create behavioral trajectories can enhance marketing effectiveness,” written in a report commissioned by an industry research report… Yet banks aren’t making full use of mobile. There are numerous use cases for deploying mobile location data that will improve the efficiency and effectiveness of banks’ marketing efforts. Data captures actual behaviors rather than what people say they have done, or intend to do, and (the writer of the report) thinks that offers clear value.”…data that captures behaviors — what people actually do — is rapidly becoming the best data to understand and predict attitudes and future behavior.”

Social Reality, a digital marketing and consumer data management technology company, announces the integration of mobile banking applications from some of the largest banks in the United States to BIGtoken, the first digital exchange of transparent and verified consumer data. Consumers can use BIGtoken to own, manage, and monetize their personal data and to control access to their information with the opportunity to earn rewards when their data is added and/or purchased by brands in secure, transparent transactions.

BIGtoken is now integrated with many of the largest financial institutions, including TD Ameritrade, Chase, Citibank, Bank of America and other top U.S. financial institutions. It is a simple step to link one’s bank account. The integration allows BIGtoken to access transaction data that the user can then choose to share with brands in broad anonymized advertising targeting segments. No personal or transactional data is shared with anyone. All data is encrypted and only readable by machines to ensure security and privacy. Users are rewarded for accessing their accounts through BIGtoken and for keeping it integrated on a monthly basis. Users are also rewarded for repeat usage. Many consumers are unaware that their data is sold based on purchase history and these integrations enable the user to get paid for their data instead of the data aggregators.

“This integration and feature is the first of many third party systems that will be added to the BIGtoken platform to further our mission of giving consumers control of their digital identity and data,” notes Kristoffer Nelson, SRAX COO and BIGtoken co-founder. “Moreover, users will continue to benefit from BIGtoken attributes of compensation and transparency. One’s personal data has become a valuable, important tool in marketing and advertising targeting, and brands have begun to leverage the data to drive sales. SRAX is very excited to integrate with the biggest names in banking so that BIGtoken users can leverage this valuable data.”

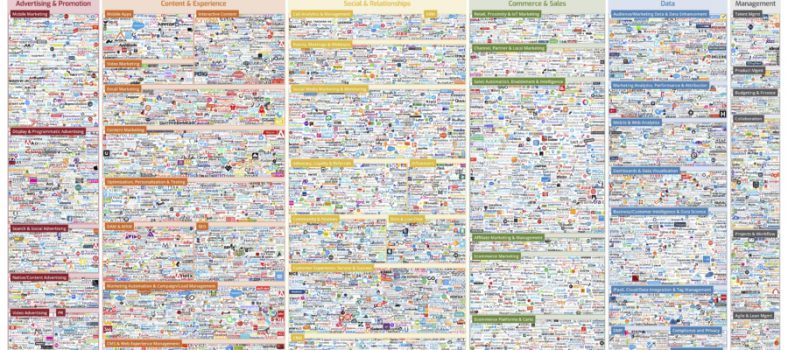

BIGtoken’s technology is revolutionizing advertising and data management for both consumers and advertisers. In addition to enabling users to claim their data and gamifying data sharing, BIGtoken allows them to delete data and opt out of data sales, all while being compensated for the use of their data. Advertisers and marketers have increasingly turned to Big Data and need a way to assure the information collected from target audiences will accurately fit their business needs. Moreover, most data is controlled by a limited number of marketing organizations and it has been difficult for other organizations to verify the accuracy of consumer data collected. BIGtoken enables the secure, decentralized, and transparent transmission of data, protecting both users and advertisers.

Other recent developments and major influences in the finance/banking industries include:

Bank of America Corporation recently the company was recognized as one of the “100 Best Companies to Work For” by Fortune magazine and the global research and consulting firm, Great Place to Work. Bank of America also was recognized as the only financial services company on Fortune’s inaugural “Best Big Companies to Work For” list, which recognizes seven companies with more than 100,000 U.S.-based employees that passed the Great Place to Work Certification bar.

Citigroup Inc.. On February 25, the company announced that Mark Mason, Chief Financial Officer of Citigroup, will present at RBC Capital Markets 2019 Financial Institutions Conference on Tuesday, March 12, 2019. Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are national federal savings banks (Members FDIC).

DISCLAIMER: FN Media Group LLC (FNM), which owns and operates Financialnewsmedia.com and MarketNewsUpdates.com, is a third party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated in any manner with any company mentioned herein.

No Comment